Sa poslednjih 50 dinara kupila je sveću – ono što je usledilo niko nije očekivao. Bilo je Badnje veče. Sneg je u Beogradu padao krupno i tiho, prekrivajući asfalt, parkirane automobile i umorna lica ljudi koji su žurili kućama sa punim kesama. Izlozi su blještali, miris pečenja širio se ulicama, a grad je delovao kao …

Damir je pritisnuo dugme na daljinskom upravljaču i velika kovana kapija sa pozlaćenim šiljcima polako se otvorila. Pred njima je stajala vila – dvorac od tri sprata, sa mermernim stubovima, kamenom fasadom boje kajsije i lavovima koji su čuvali prilaz. Bio je to krunski dokaz njihovih trideset godina rintanja po Štutgartu, noćnih smjena, štednje i …

Crni, glomazni džip sa zatamnjenim staklima polako se peo uz brdo, podižući oblak prašine na starom seoskom putu. Deda Života je sjedio na tremu svoje kuće, na onoj niskoj drvenoj stolici koju je sam napravio prije četrdeset godina. Gulio je jabuku čakijom i gledao u to čudovište od auta koje mu ulazi u avliju. Znao …

Starica je naručila samo dva metra drva, jer za više nije imala novca. Kamion je istovario deset, a kad se saznalo da to nije bila greška nego nečija tiha dobrota, niko nije slutio kakav će se lom u toj kući dogoditi iste večeri. Sin je došao predveče, dok se nebo već zatvaralo, a hladnoća …

Crni Mercedes njemačkih registarskih oznaka polako je klizio kroz maglu koja je okovala malo slavonsko selo. Mate je čvrsto stezao volan, osjećajući mješavinu ponosa i nervoze. Nije dolazio kući pet godina. Posao u Münchenu, gradnja firme, djeca, škola… život ga je samljeo. Ali redovno je slao novac. I to ne malo novca. Slao je “debele” …

Ispred najluksuznijeg hotela u Sarajevu, te subotnje večeri, bila je parkirana kolona automobila koja je vrijedila više nego cijelo selo iz kojeg je došao Ibro. Sijale su se limuzine, džipovi sa zatamnjenim staklima, a gosti su izlazili u haljinama od svile i odijelima koja se ne kupuju u običnim radnjama. Bila je to svadba godine. …

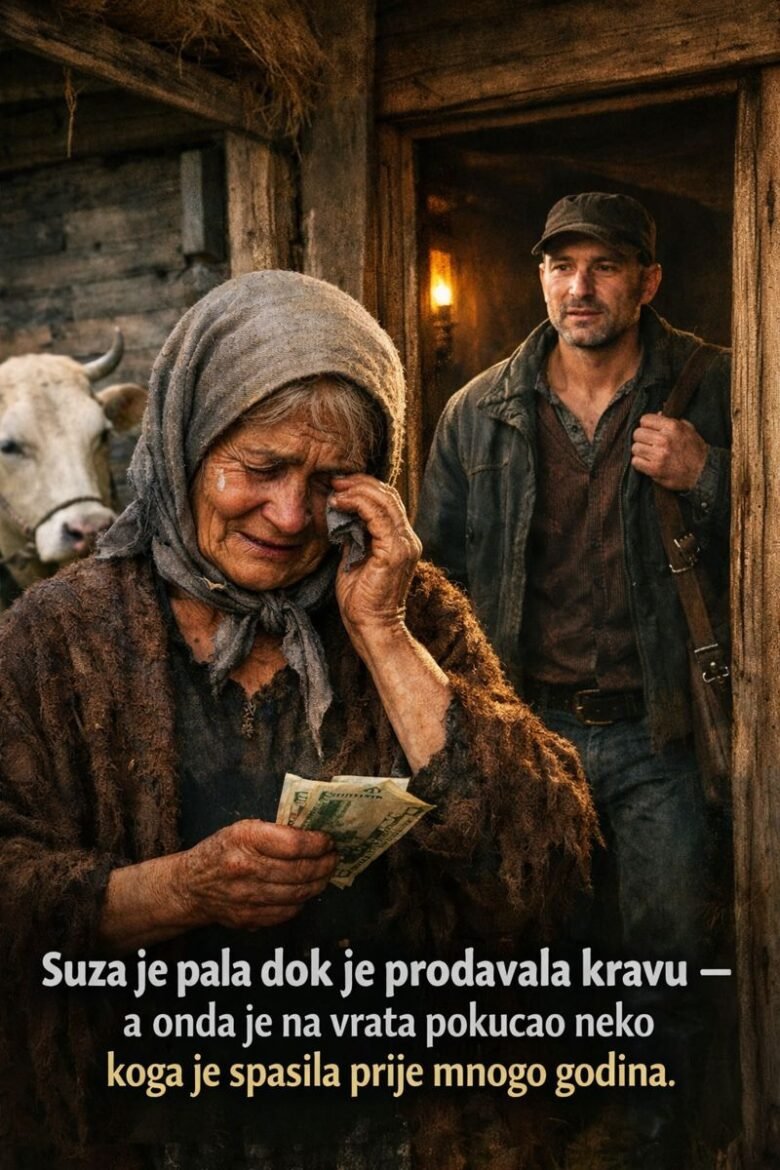

Zima je te godine u bosanskim brdima pokazala svoje najstrašnije zube. Snijeg je zatrpao sela do krovova, a minusi su pucali kao topovi u noći. U maloj, trošnoj kući na kraju sela, nana Fata je živjela sama sa svojom kravom Šaruljom. Šarulja nije bila obična krava; ona je bila Fatin jedini razgovor, njena grijalica i …

Dom za stare “Zlatna jesen” na obodu Beograda bio je jedan od onih skupih, luksuznih objekata koji više liče na hotel nego na bolnicu. Mermerni podovi, umetničke slike na zidovima, pogled na park. Ljiljana, uspešna direktorka marketinga velike strane firme, plaćala je taj dom papreno. Smatrala je da je time rešila “problem” brige o svojoj …

Kada je otac poginuo u rudniku, kuća je ostala bez stuba, a dvoje djece bez izbora. Majka je zanijemila od tuge, a siromaštvo je ušlo kroz vrata bez kucanja. Adnan je tada imao osamnaest godina. Bio je najbolji učenik u gimnaziji, đak generacije, sa snom da upiše medicinu u Sarajevu. Njegova mlađa sestra Selma …

Za Radu, u selu se govorilo da je „gospođa“. Njena kuća imala je najvišu ogradu, najskuplju fasadu i najhladniji osmijeh. Otkako je ostala udovica sa stranom penzijom, Rada je sjedila u svojoj plišanoj fotelji kao na prijestolju i dijelila presude svima. A niko nije bio kriv kao njena snaja Milica. Milica je došla „bez miraza“. …