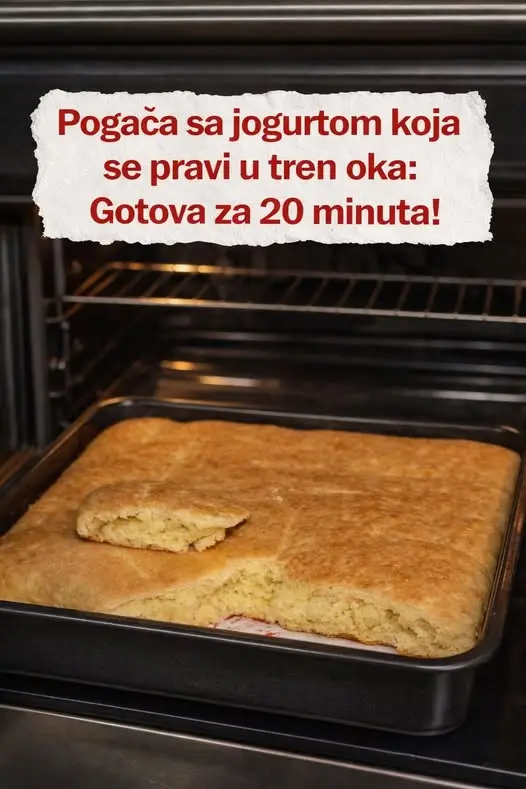

POGAČA SA JOGURTOM – gotova za 20 minuta 📝 Sastojci: 2 jaja 1 čaša jogurta (180–200 ml) 1/2 čaše ulja 1 kašičica soli 1 prašak za pecivo oko 400 g glatkog brašna (T-400 / T-500) (čaša = 200 ml) 👩🍳 Priprema: U činiji umutiti jaja, dodati …

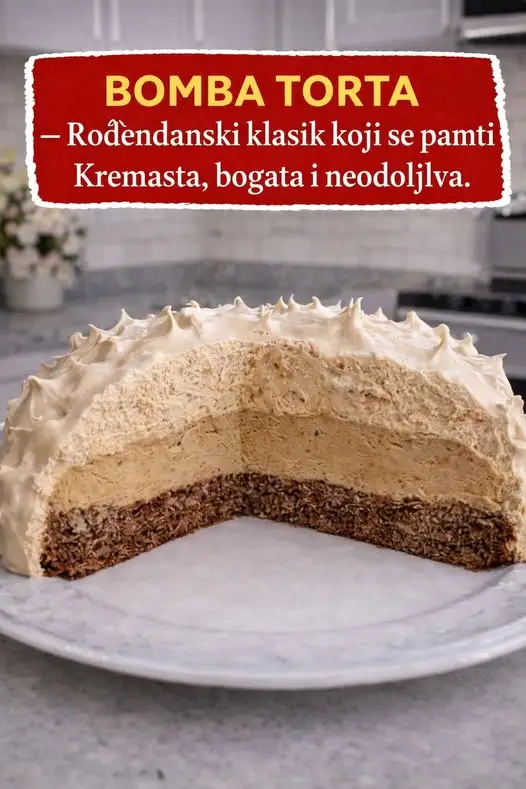

🎂 BOMBA TORTA Kremasta, bogata i neodoljiva 📝 Sastojci: Kora (bez pečenja): 300 g mlevenog keksa (Plazma ili petit) 150 g mlevenih oraha 100 g šećera u prahu 120 ml mleka 100 g otopljenog maslaca ili margarina Fil: 5 žumanaca 150 g šećera 2 vanilin šećera …

ŠTRUDLICE SA JABUKAMA 🧁 Sastojci: Testo: 250 g glatkog brašna 125 g margarina ili maslaca 1 jaje 2 kašike kisele pavlake ili jogurta 1 kašika šećera 1 vanilin šećer prstohvat soli Fil: 4–5 srednjih jabuka (rendane) 3–4 kašike šećera (po ukusu) 1 vanilin šećer …

🍫 GREŠNE KOCKE ZA 5 MINUTA Kada ih jednom probate, uvek ćete im se vraćati! Pleh: 20×20 cm (ili manji) Sastojci: 300 g mlevenog keksa (Plazma / petit) 100 g seckanih oraha ili lešnika 150 g šećera 100 ml vode 125 g margarina ili maslaca 100 g …

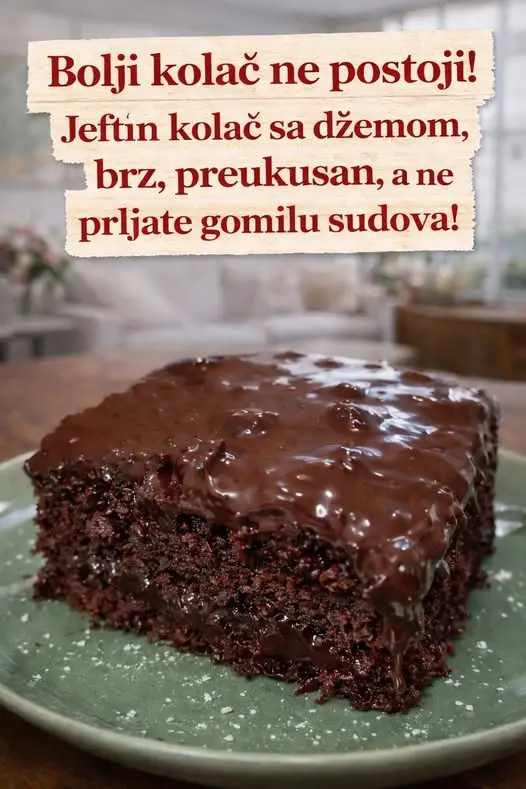

🍰 JEFTIN KOLAČ SA DŽEMOM Brz, preukusan i bez gomile sudova Sastojci: 1 čaša (200 ml) jogurta 1 čaša šećera ½ čaše ulja 2 kašike kakaa 2 kašike džema (kajsija, šipak ili jagoda) 2 čaše glatkog brašna 1 kesica praška za pecivo Prstohvat soli Čokoladna glazura: 100 g čokolade za kuvanje 2 kašike ulja 2 …

🍰 ŠAMPITA SA 4 JAJA Jednostavan recept koji će svi obožavati Sastojci 🟡 Biskvit: 4 žumanca 4 kašike šećera 4 kašike ulja 4 kašike mleka 4 kašike glatkog brašna ½ kesice praška za pecivo ⚪ Šaum: 4 belanca 4 kašike šećera 2 vanilin …

🍨 NAJBRŽI DESERT BEZ PEČENJA Gotov za 5 minuta i nestaje brže nego što mislite! Sastojci (činija srednje veličine) 500 ml slatke pavlake 200 g krem sira (ABC, Philadelphia ili sličan) 100 g šećera u prahu 1 vanilin šećer 200 g mlevenog keksa (Plazma ili petit beurre) …

PLAZMA TORTA BOLJA OD SLADOLEDA – bez pečenja, gotova za 15 minuta. 🍰 PLAZMA TORTA BOLJA OD SLADOLEDA Bez rerne | Kremasta | Osvežavajuća Sastojci: 300 g mlevene Plazme 200 ml slatke pavlake (za umutiti) 200 g kisele pavlake 200 g krem sira (ili sitnog sira – pasirano) …

🍰 NAJBRŽA KEKS TORTA SA BANANAMA (15 MINUTA) 🧺 SASTOJCI 300 g petit keksa (ili Plazma) oko 200 ml mleka (za umakanje keksa) 3–4 zrele banane Čokoladni krem: 500 ml mleka 2 pudinga od čokolade 4 kašike šećera 100 g čokolade za kuvanje 125 g margarina …

Potrebno je: 300g svinjske masti ili putera, margarina 2 jaja 1,5 do 2 male kašičice soli 2 dl belog vina 1 prašak za pecivo 500g sira 300g krupno mlevenog kikirikija- pečen ili blanširan 700 do 750g brašna Semenje susam, kim, čurokot – dodajte po svom ukusu Formirane oblike peciva premažite sa smesom od jednog jajeta …